Forex Support And Resistance - The Best Trading Strategy

A quick search of the forums and it didn’t take me long to find traders posting up charts littered with Forex Support and Resistance lines that are way overdone. Instead of keeping things straight forward and simple, this trader has gone overboard and created an environment that is impractical and just down right too difficult to trade in. There is absolutely no need for this and is extreme overkill. Support and resistance make up the major boundaries of ranging markets, when a market is range bound the only levels you really need to have marked out is the upper resistance ceiling and the lower support floor of the range. forextradingsignal.shutterfly.com Nearly every single technical trading system will rely on you the trader having the ability to correctly Draw Support And Resistance levels on your chart. Mapping out support and resistance is really the most important core skill any serious traders will need to have a good grasp on. If you can’t draw your support and resistance then your trading as a whole will implode on itself. Support And Resistance is a concept that the market will experience opposition to one degree or another in a certain area. That means that the market will tend to struggle at areas of Support and Resistance and often times bounce.

The ability to draw support and resistance correctly is learned over time and patience, so don’t give up. If you’ve got a chart that’s loaded up with so many lines that you don’t even know what you’re looking at anymore, then you’re doing it wrong. Acquiring the skill of marking out support and resistance is super important for any trader because it’s the backbone of any trading system you come across. Support and resistance are specific price areas or price levels which either support prices on declines in up trends or which resist prices on rallies in down trends. In an uptrend, short term and day traders will attempt to buy at support or at levels of support. In a down trend, short term and day traders will attempt to sell at resistance levels or in resistance areas. If support and resistance levels cannot be determined, then you cannot define concise levels in which to establish entry or exit positions in your specific trade. It is of utmost importance for traders to develop effective strategies and methodologies for calculating support and resistance levels.

Support And Resistance levels are used by investors to determine how far they believe a currency pair will move. This also tells them at what points the price action may turn around and start moving in the opposite direction. But sometimes, the markets change direction due to a fundamental factor. The market change of direction is strong enough to cause a currency pair to break through a previously established support and resistance level. Click This Link for getting more information related to Draw Support and Resistance as well as, Support and Resistance.

Using Candlestick Chart Patterns in Your Trading Can Help You Identify High Probability Opportunities!

Forex candlestick patterns can be usually checked out as bullish or bearish. Favorable, when the market fad is downward relocating and bearish when it is up. Some certain Forex Candlestick Patterns that you might experience are Doji - this pattern could trigger complication among investors and commonly represents indecision in the currency market, hammer - this pattern is formed after a decline and a sign of possible reversal in the currency market, engulfing - one candlestick 'engulfs' the various other as the physical body of the candle light in the previous day is had in the physical body of the candle light in day 2. To be successful in knowing forex candlestick patterns, share your experiences with various other investors, however follow your personal judgment. While it can be handy to review the suggestions that supply you, your investment choices ultimately rest with you. forex-tradings-signal.weebly.com The Forex candlestick patterns rely upon the technical evaluation of your market factors. A predictive design can assist you to establish the quantity data and chance expense. The forex candlestick patterns exist in considerably vibrant visual collections so that the customer can effortlessly translate them. Investor belief will certainly help you to pick up the kinds of shares that are best to buy. There are a collection of patterns including short and lengthy days. Others consist of the White and black Marubozu. You could consider the spinning tops, rainfall declines and superstars.

Candlestick chart patterns are drawn not just gives the instructions of rate, but also the energy behind the step. Candlestick charting offers better insight into human psychology. They introduce human emotion to life right just before your eyes and that's a great benefit to have, to initiate new positions or as a caution to cut and run! To the newbie a candlestick chart could look confusing but every investor understands that they are an important tool. Candlestick charts are there for convenience. They are a fantastic means of imagining what is taking place in a market without actually having to take a look at any kind of figures. Candlestick Chart Patterns for all intents and purposes, are just responses of traders at a specific time in the marketplace. The truth that humans typically react en masse to scenarios allows candlestick chart analysis to function. Candles likewise combine well with various other devices of technical analysis such as assistance and resistance, moving average, and indicators such, stochastic, RSI, ADX and MACD to call however a few. There are many candlestick patterns but just a few are actually worth recognizing.

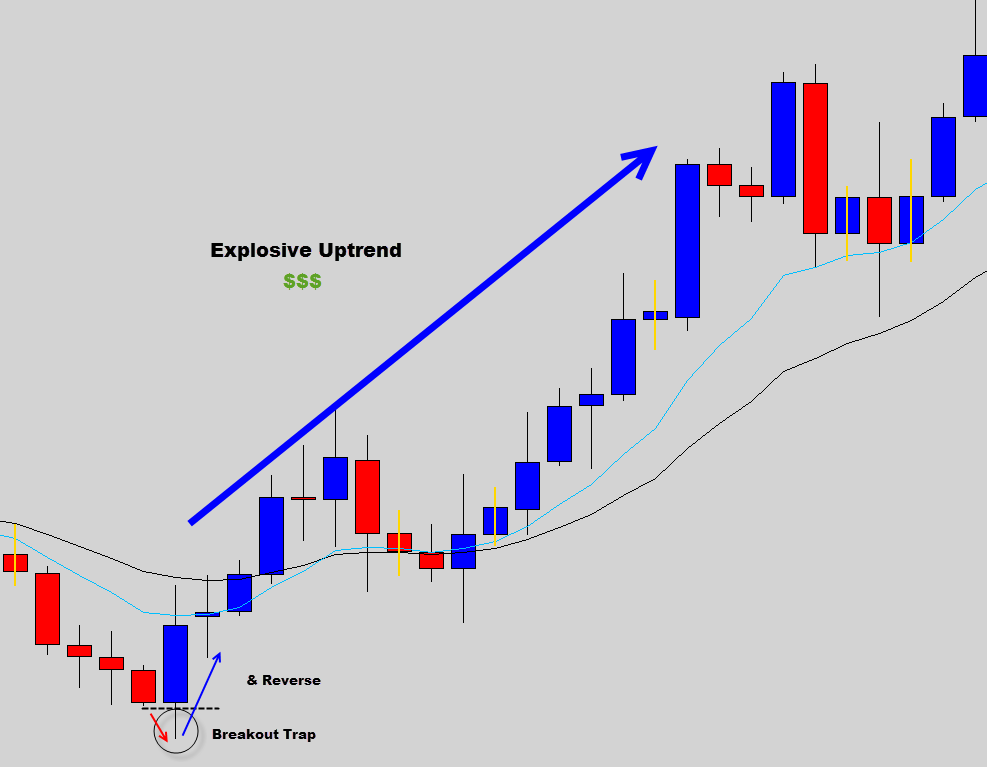

Candlestick chart patterns offer independent financiers and economic institutions a method to look at cost variations from an one-of-a-kind viewpoint. These charts are most generally utilized for day trading stocks, commodities, and currency (Forex). However, they can actually be used properly by any type of financier in any type of market. A certain collection of famous Candlestick Patterns disclose general market sentiment at any provided time. They could also suggest the future direction of trading over the short-term. A daily chart that shows candle holders could incorporate various other standard indications such as moving averages and Bollinger bands. Click This Link for obtaining more information related to Forex candlestick patterns along with, candlestick patterns.Best Forex Signals - Learn How to Make Easy Money Now!There are many candlestick formations out there. Some of them are just made up of one particular single candlestick structure; others can be made up from combinations of two or even three candles. The Best Forex Signals are generally comprised of one or two candlesticks. This is one of my favorite setups, and one of the Best Forex Signals used with price action trading. Breakouts occur when price breaches some sort of containment. Some breakout events produce very explosive moves, but you’ve got to know the correct time to trade these breakouts because not all of them actually work out the way you would expect them two. There are critical areas where breakout traps are highly prone to occur. Most unsuspecting traders will blindly trade the initial breakouts from these high risk areas on the chart.

A breakout trap occurs when a price breaks out of the high risk containment area and triggers breakout traders to jump into the breakout movement. All of a sudden the market collapses back in on itself ‘trapping’ those unsuspecting traders into a false move. We like to keep things simple and effective here at The Forex Guy. We use only the Best Forex Signals built on candlestick setups that have proven to produce the best results in everyday trading. Forex Trading Signals is known to be the strongest unifying factor and a prominent aspect in forex trading. These currency trade signals are ranges of international currency information from diverse currency trading sources. Tracing back in the early times of forex trade, majority of traders used tickers as a means of transporting and conveying relevant information through major communication lines such as radios and telephones.

Today, with the dawn of the most modern and latest technology coupled with the introduction of the internet as one of the major players in trading forex, erstwhile trading have been shunned to make way for a far better and efficient strategy in trading forex. Now, professional and even novice traders have the power to trade in real time using real and reliable Forex Trading Signals. The rationale is similar with forex trading signals, without these vital signals, significant information is obstructed and hindered thereby creating a possible downfall in the forex market. Forex Signals trading is one of the most popular instruments employed by Forex investors to maximize their earning potential inside the Foreign exchange market. This instrument includes discovering trends by analyzing charts. There are also indicators that you can employ to do Forex signal trading. Forex Signals trading helps you, as the trader, on what is the right time to buy or sell a particular currency. Signal trading is commonly done by brokers and analysts that you can employ to utilize signal trading. Signal trading may truly give you the opportunity of acquiring huge gain in the Forex market. With signal trading in the Forex market, you are able to really increment your gaining potential and minimize the danger of no profit or losing money. Navigate To This Website for getting more information related to Best Forex Signals as well as, Forex Trading Signals. |

||||

Make a Free Website with Yola.